when are property taxes due in madison county illinois

Current Tax Year-Taxing District Levy. Madison County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Illinois Tod Deed Form Get A Transfer On Death Deed Online

In Illinois there is no set property tax rate.

. Madison County Property taxes are paid in four installments. Madison County Auditor Financial Reports. 125 Edwardsville IL 62025 618.

Welcome to Madison County Illinois. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 1 day agoMarion County Treasurer Gary Purcell is reminding taxpayers that the second installment of property taxes is due by Tuesday September 27th to avoid interest and.

LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at. Madison County collects on average 175 of a propertys. 125 Edwardsville IL 62025.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. For comparison the median home value in Madison County is. Madison County Property Tax Inquiry.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. 173 of home value.

Property tax is a local tax on real estate land buildings and permanent fixtures that is imposed by local taxing districts and is based on a propertys value. For now the September 1 deadline for the second installment of property taxes will remain unchanged. 1 day agoThe Illinois Policy Institute estimates that if passed property taxes in Madison County could increase by 646 over the next four years and increase by 834 over the same.

You can pay your taxes in person at the McHenry County Treasurers Office by mail or online. Illinois gives real estate taxation power to thousands of community-based public entities. Instead of your property taxes your homes equalized assessed value EAV.

What is property tax. Madison County collects on average 175 of a propertys. Property tax due dates for 2019 taxes payable in 2020.

Gwen Henry the countys treasurer is the countys clerk. When are taxes due in Madison County. Still property owners generally pay a single consolidated tax levy from the county.

Madison County Auditor Check Register. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. Tax amount varies by county.

To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site. In most counties property taxes are paid in two installments usually June 1 and September 1. If you live in McHenry County property taxes are due on June 1st of each year.

Madison County Treasurer IL 157 North Main Street Ste. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. Statement of Economic Interest.

Madison County collects on average 175 of a propertys. Pay your Madison County Illinois property tax bills online using this service. 2019 payable 2020 tax bills are being mailed May 1.

Illinois Sales Tax Guide For Businesses

Tax Lien Registry Tax Lien Registry

706 Grove Alton Il 62002 4111244 Real Estate Riverbender Com Real Estate Alton House Styles

Illinois Property Tax Exemptions What S Available Credit Karma

Downtown Alton Illinois Alton Illinois Alton Great River

Billy Corgan Pays Some Of The Highest Property Taxes In The Chicago Suburbs Chicago Suburbs Billy Corgan Chicago Lake

16 Lasalle Elsah Il 62028 Realtor Com

Recent Changes To Illinois Alimony Law 2022

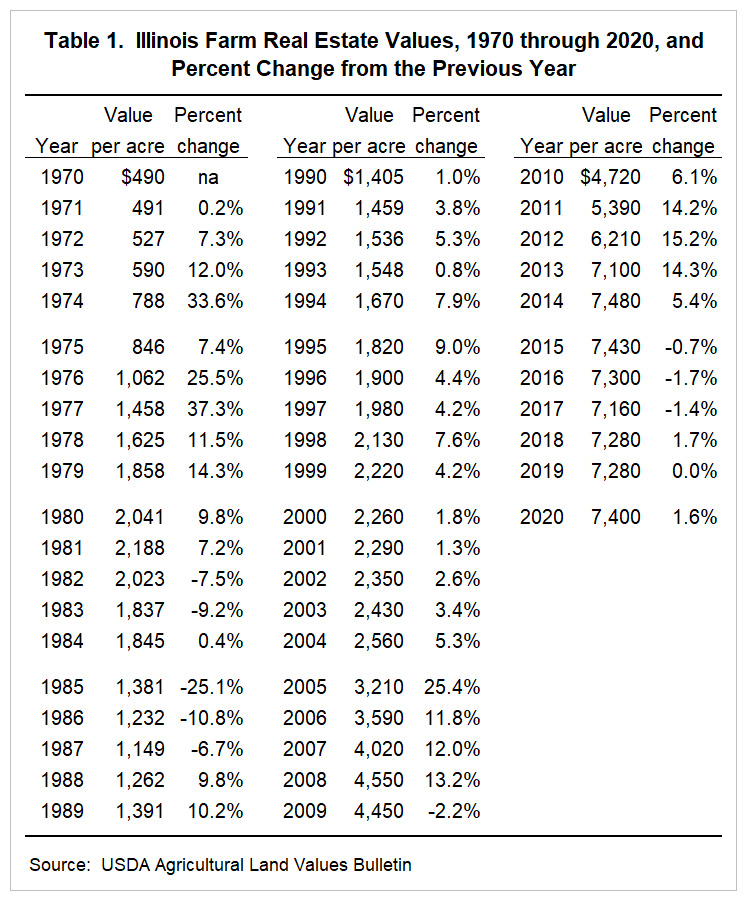

Information On 2021 Cash Rents With Implications For 2022 Farmdoc Daily

Assessor S Office Crawford County Illinois

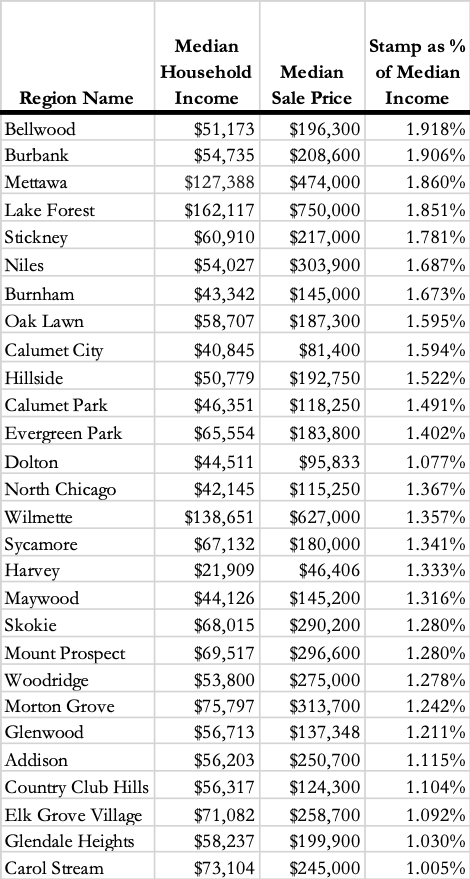

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Sales Tax Guide For Businesses

Slight Increase In Illinois Farm Real Estate Values For 2020 Farmdoc Daily